I’m not an economist, nor am I a financial guru who understands the finer points of stock trading. I am, however, a person who has a good understanding of human nature and the way in which a media — who is always chasing drama — frames stories that really don’t have an effect on the average Joe or Jane. Case in point: the recent stock market meltdown. Pictures and graphics paint a thousand words, so it’s easy for newspapers or TV newscasts to pepper in images like this to make us feel panicked:

Or this:

Or this:

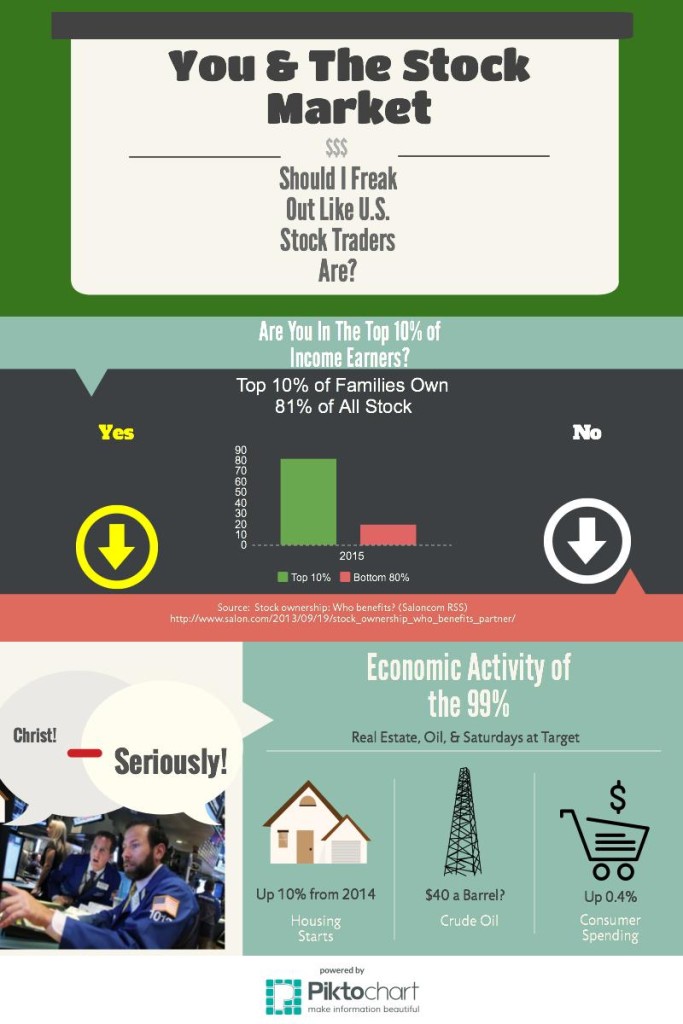

The media coverage of the global market shock over the loss/correction of stocks is covered with the same breathlessness as one covers a homicide. That is to say, THE WORLD IS ENDING (or so it seems). Read a little deeper and one finds that if you’re in the U.S., the stock market decline shouldn’t have much of an effect on the proverbial 99%. Why? Simply put, rich people own most of the stock.

But! But! But!

What about the “ripple effect” of the 1% losing so much in such a short period of time? Won’t that affect the economy? Not necessarily. What it will affect are all those people who jumped into the stock market because they thought it was a safe bet. After all, with the all the indices showing growth year after year, most who jumped on thought the gravy train would last a mighty long time. Well, it’s the stock market, kids. Legalized betting/stock trading is risky. People often say, you could lose your shirt, and just like a weekend in Vegas, you could walk out of a casino with zero cash if you placed lousy bets. The same goes for the stock market. If you weren’t watching China devaluing their currency, the price of crude oil dropping, or even the Chinese export market slowing, you probably freaked out at some point during the last few days saying, “This is too rich for my blood”… and sold stocks on Monday.

Now, will this sell-off/correction/China’s economy is built on a fiction lead to massive layoffs in the U.S.? Most who have been watching the economic health of the U.S. say no. What they are seeing are that indices like consumer spending, real estate starts, and the unemployment rate are not showing signs of weakness. Part of that is because the U.S. isn’t as dependent on exports as, say, China — nor are we a petrol state like Venezuela, Iraq, and Russia. We spur a lot of our economic growth through domestic spending, and right now those levels are pretty healthy.

Sure, things can go south if other countries start to fall into a deep recession, but a couple of things point toward some benefits to the 99% when it comes to this correction. The first is cheaper oil. That means less money goes into the tank and can be spent on other things (even personal debt reduction). The second is housing. Simply buying a house isn’t the single driver in that part of the economy. It’s the “stuff” you fill your house up with that pushes the economy into a virtuous cycle. Now bubbles like this don’t last, but these elements may be enough to keep the U.S. from another deep recession. Time will indeed tell, and no one has a crystal ball, but if you remember how George Bailey in “It’s a Wonderful Life” kept a fairly clear and cool head when the bottom was falling out the economy, it’s a good lesson in stepping back, taking a deep breath, and understanding market volatility is a reflection of our own state of mind.

Comments