I don’t know if you remember the days when newscasters would routinely smile when the Dow Jones Industrial Average ended the day in positive numbers. It was a not-so-subtle sign that “The system is working” for those who profited from the financial sector.Á‚ For the rest of us, a smile meant good news — even though we probably had no idea what they hell the numbers meant, or what all this talk about “The Dow” was about.

Something like that is happening now, as newspapers report the surge in stock markets.Á‚ And it’s clear that the move many countries have made to nationalize banks and inject capital into the system to loosen up credit may have the desired effect.Á‚ The headlines won’t say anything about “Socialism Saves Capitalism,” but that’s pretty much what’s going on. Yes, it is ironic, but if we’ve learned anything in last eight years, irony has reigned supreme among the Bush Administration and the Republican Party.

The party that supposedly hates nation-building, had to become advocates of nation-building.Á‚ The party that promotes freedom and derides “government interference” were zealous in supporting policies that lead to government intrusion into the lives of Americans. The party that believes in low taxes and curbing government growth, spent tax money and increased the size of federal bureaucracies in a way that would give FDR chills.Á‚ And finally, the party that has been ramming through deregulation policies affecting the financial sector, has had to French kiss socialism to provide a trillion dollar safety net to keep the world-wide economic panic from reaching a depression.

I don’t think the Democratic Party is in much better shape. If Barack Obama wins the election, his administration will have to make equally tough choices on how to lead the country out of this economic and political mess.Á‚ It will probably mean abandoning campaign promises, tacking right on some issues (most likely tax policy) and continuing the war he promised to get us out of.Á‚ I’m not saying that’s what will happen, but given how fluid events have been in the last couple of months, it’s very likely the specter of Bill Clinton and the DLC will hover over the day-to-day operations of an Obama Administration.

But back to the Dow for a moment — because, you know, it’s the economy, stupid.Á‚ A couple of weeks ago I joined a rather dour group of economists on a conference call through the RGE Monitor. They were analyzing the political response to the financial crisis, and because all the speakers were economists, they spoke a language all their own.Á‚ Feverish talk about Ted spreads, LIBOR rates and the like were bandied about to the point of dizziness.Á‚ Interestingly enough, there was very little talk about the Dow, or other stock market indicators, and, not being an economist, I wondered why.Á‚ My answer came not from the conference call, but from my local paper.Á‚ A heartfelt thanks to Kathleen Pender at the San Francisco Chronicle for helping me, and others, with a quick glossary of terms as the psychology of the credit crunch plays out.Á‚ I’m not holding out hope, but it will be interesting to see if John McCain or Barack Obama can communicate how their policies will affect the indicators below in a folksy way from now until the election.

Okay, are you ready for your speed date on economic terms?Á‚ Here we go …

Investors freaking out over stocks tanking will often invest in T-Bills as a place to keep their money. When the three month yield on T-Bills is low (say, .25%, as it was on 10/10) it means, as George Costanza from Seinfeld would say, “there’s shrinkage” in the market and investors are fearful of swimming in the cold water.Á‚ When the three month yield starts to go up, it means investors are feeling a bit more confident about market conditions, pop a Viagra, liquidate their T-Bill investments, and put their money elsewhere.

The London Interbank Offered Rate (LIBOR)

This is the rate banks lend to other banks, and the loans are for short periods of time (though, not always). If the LIBOR rate is close to what the Fed is lending banks, then things are trending in a direction that says: “Baby Jesus is saving corporate capitalism.”Á‚ Just compare the LIBOR rate to the Federal Reserve Discount rate and you’ll see if Baby Jesus is working his magic.

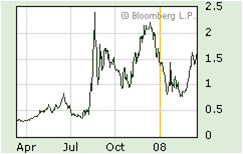

Another indicator that compares data sets. The “spread” gives you data to measure the Fear Factor in the markets — and the number to watch is the difference between the three month LIBOR rate and the three month yield of T-Bills.Á‚ Fortunately for us, the Ted Spread calculates that difference, so put your calculators away.Á‚ The higher the number, the more fear there is in the market, the more my first name is mud.

So, these are some indices to watch as this recession continues and we read the daily tea leaves of market psychology.Á‚ While stock market activity is certainly grabbing the headlines, have fun at home by being a bit more savvy with the economic news and keep your eyes on the indicators that are more telling than the ups, downs, smiles, and frowns of The Dow.

Comments