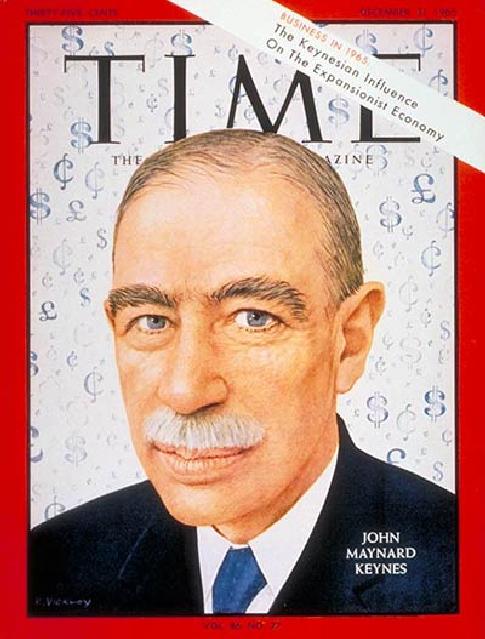

Because I’m geeky that way, I’ve been working through Robert Skidelsky’s biography of John Maynard Keynes. In some circles, Keynes is just as bad as Darwin, a godless heathen taking away the divinely ordained tax cuts on the rich. It probably doesn’t help that he was gay, married to a Russian (a woman, but we all know what Russians symbolize in economics), and a member of the Bloomsbury Group.

Because I’m geeky that way, I’ve been working through Robert Skidelsky’s biography of John Maynard Keynes. In some circles, Keynes is just as bad as Darwin, a godless heathen taking away the divinely ordained tax cuts on the rich. It probably doesn’t help that he was gay, married to a Russian (a woman, but we all know what Russians symbolize in economics), and a member of the Bloomsbury Group.

Keynes has become shorthand for “spend more than you make in the hopes of improving the economy.” But that’s not what he stood for at all. He made his mark after the first World War with The Economic Consequences of the Peace , a discussion of the problems with the Treaty of Versailles. The treaty required Germany to pay reparations to England, France, and the U.S., and Keynes pointed out that Germany did not have the money, would print money to meet the demand, and would sacrifice its domestic economy and political stability to give money to nations that did not need it. And Keynes was right: the German government spent money it did not have on reparations. It printed money, leading to hyperinflation, and created a climate that allowed a madman to come to power in an attempt to assert Germany superiority over those it was forced to pay.

It’s not that Keynesian theory recommends deficit spending. Instead, it recommends government spending during those times when consumer spending and private-sector investing would not be enough to support economic growth.

The basic equation is C + I + G = GDP, where C is consumer spending, I is business investment, and G is government spending. Added together, they equal gross domestic product. If the government taxes people in order to spend money, it could crowd out consumer spending and business investment. But if consumer spending and business investment are falling, then government spending is the way to force GDP back up.

In other words, there are times when it makes sense for the government to spend money, and times when it does not. Because I don’t see consumers and businesses rushing to pick up the slack right now, it would seem that the responsibility falls to our duly elected and appointed leaders. On the other hand, if consumers and businesses were throwing cash around, it would be all right for the government to cut back.

If the government finds itself in a situation where it needs to spend money regardless of the economic climate — such as in a war — it would be acceptable to reduce consumer and business spending through tax increases in order to keep prices from inflating. This is contrary to the conservative conventional wisdom that tax cuts, especially for rich folks, cure all economic ills.

Right now, all of those loyal Republicans who supported George Bush’s tax cuts during a time of war have suddenly decided that they stand for fiscal conservatism. Not only are they hypocrites, but their weak will got us into this mess in the first place. Their foolish tax cuts not only led to a record Federal deficit, but also inflation. We have had asset price inflation in the real estate and commodity markets and cost inflation in the health care and financial services industries. The Federal Reserve bank tried to fight inflation by keeping interest rates artificially low, and that lead to our current deflationary climate when those bubbles finally burst.

Consumers borrowed money during the run-up, so they have no money left to spend. Businesses took advantage of the low rates of the early 2000s to invest, so they don’t need to expand now. Instead, most businesses are cutting back to match the cutbacks in consumer spending. The parts of our nation’s infrastructure that lag are those that are best handled by government such as road construction, education, and healthcare. These create good jobs, for engineers and construction workers, teachers from preschool through college, nurses’ aides and surgeons. (Businesses aren’t interested because the profit potential in these sectors isn’t very big.)

The Keynesian prescription of deficit spending by the government fits what ails us now. When we get past this, whether in ten months or ten years, the government can scale back so that consumers and businesses can grow. Tax cuts got us into this mess; they can’t get us out.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=550398ad-3b45-43c9-b795-1862dd2c7393)

Comments